In the dynamic world of forex trading, having a well-structured framework is essential for success. A robust trading framework not only helps in executing trades but also provides a clear pathway for analysis and improvement over time. If you’re looking to enhance your trading strategies, a comprehensive set of professional guidelines will set you on the right track. For more insights, visit forex trading framework professional guidelines forex-level.com.

The forex market operates 24 hours a day, with traders from all over the world exchanging currencies. Understanding how this market functions is crucial for any trader. Begin by familiarizing yourself with the major currency pairs, market trends, and economic indicators that influence currency values. Knowledge of the geopolitical landscape can also impact trading decisions.

A solid trading strategy is the cornerstone of successful forex trading. Traders must define their goals, risk tolerance, and preferred trading style—be it day trading, swing trading, or long-term investing. Your strategy should incorporate technical analysis and fundamental analysis to identify entry and exit points effectively.

Technical analysis involves evaluating price charts and indicators to forecast future market movements. Key tools include moving averages, RSI, MACD, and Fibonacci retracement levels. Understanding these tools can help traders make informed decisions based on past market behavior.

Fundamental analysis focuses on economic events, news releases, and macroeconomic indicators like GDP, unemployment rates, and interest rates. Staying updated with these factors allows traders to gauge market sentiment and anticipate potential price movements.

Risk management is vital for protecting your trading capital. A good rule of thumb is to risk only a small percentage of your account on a single trade—typically between 1% to 3%. Use stop-loss orders to minimize losses and take-profit levels to secure gains. Additionally, maintain a balanced portfolio to diversify risks.

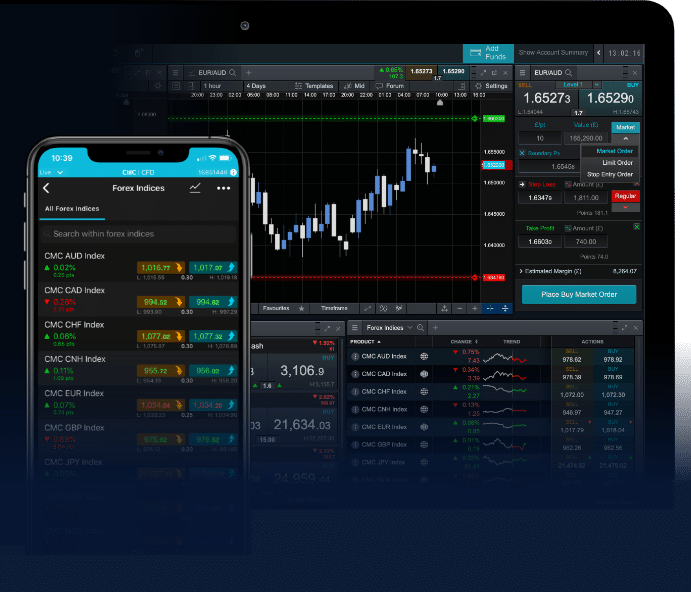

Selecting a trustworthy and user-friendly trading platform is crucial for executing trades efficiently. Look for platforms that offer advanced charting tools, news feeds, and reliable customer support. Ensure the broker is regulated by a recognized authority to safeguard your investments.

Consistent improvement is key to long-term success in forex trading. Regularly analyze your trades to identify patterns, strengths, and areas needing improvement. Keeping a trading journal helps in documenting your decisions, outcomes, and emotional responses during trading. This practice encourages accountability and allows for strategic adjustments as needed.

Discipline is essential when adhering to your trading strategy, especially in volatile markets. It ensures that you stick to your risk management rules and avoid emotional trading decisions. However, be prepared to adapt your strategy based on changing market conditions. The forex market is highly dynamic, and flexibility can be a trader’s greatest asset.

The forex market is ever-evolving, necessitating continuous learning. Engage in webinars, workshops, and online courses to enhance your knowledge and skills. Joining trading communities or forums can also offer valuable insights and support from fellow traders.

Set realistic trading goals that motivate you without overwhelming you. These could be monthly profit targets, the number of successful trades, or the development of new strategies. Establish metrics to measure your performance objectively and celebrate small victories to maintain your motivation.

Your mindset plays a significant role in trading outcomes. Emotional responses can lead to impulsive decisions, potentially resulting in losses. Develop strategies to manage stress, such as setting aside time for breaks and engaging in activities that refresh your mind. Mindfulness and visualization techniques can also help reduce anxiety and improve focus.

What works today may not work tomorrow. Continuously innovate your trading framework by incorporating new strategies and tools. Experiment with different indicators, techniques, and trading styles to see what aligns best with your objectives and preferences.

Creating a professional forex trading framework requires dedication, discipline, and an ongoing commitment to education. By following these guidelines, traders can enhance their skills, manage risks effectively, and improve their chances for success in the myriad of opportunities that the forex market presents. Remember, the key to mastery lies not just in understanding the market but in staying adaptable and continuously evolving along with it.